9 Biggest Payroll Challenges In 2021

Whether small or large, every business handles payroll in their own way, which governs how it handles all payments owed to employees and contract employees (freelancers).

An organisation must ensure that every pay, tax bill, invoices, and data input aligns with the compliance laws. Many complex procedures are involved since the tax laws, and compliance rules keep changing from time to time!😕

This means more difficult payroll processes, more data, and more effort. Fortunately, you can address all of these payroll processing challenges with the help of a payroll software and focus on hiring from a bigger talent pool!😍

Many HR professionals are eager to explore the world for talented recruits, but technicalities sometimes appear to be an impediment that businesses must overcome. The majority of them involve payroll management.

Calculating payroll and distributing salaries may appear to be a simple task; however, it is not. In fact, while running the payrolls, an HR professional faces several difficulties. Recognizing your payroll processing challenges is the first step towards identifying appropriate solutions to overcome them.

It’s important to get your payroll right✅: paying employees incorrectly or untimely can hurt employee morale, and failure to comply with tax or labor laws can result in severe penalties.

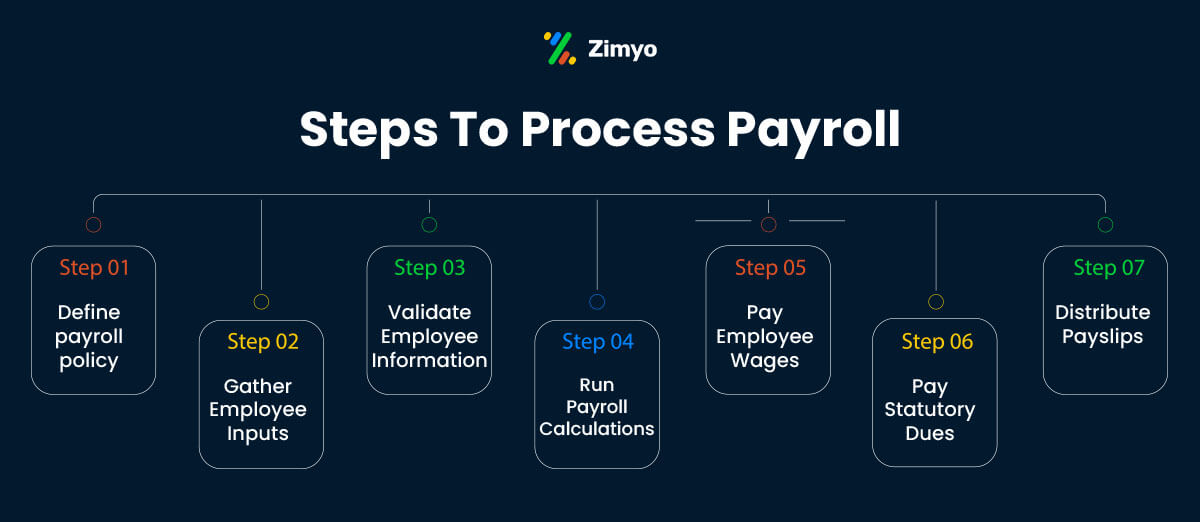

Steps Involved In Payroll Management Process

Payroll management determines employee pay, deductions, tax computations, bonuses, and compliance, among other things.

The following are the primary steps in payroll processing:👇

- The first step is to establish a payroll policy. Fix your payroll processing norms, including guidelines for leave, attendance, and compensation.

- The second step involves keeping an eye on the various departments’ contributions. For example, attendance records, tax requirements, leave records, and so forth.

- Once you’ve gathered the data for payroll processing, you’ll need to check it for accuracy and legitimacy. For instance, knowing the exact amount of unpaid leaves taken by an employee.

- After you’ve gathered this information, you’ll need to run payroll calculations, including deductions and taxes.

- Payroll management calculations are accompanied by ensuring statutory compliance, such as TDS, EPF, etc.

- After completing the payroll, you’ll need to enter everything into your accounting software for precise accounting and administration.

- The second and final stage is to distribute payments to employees and provide them with pay slips. This phase entails keeping track of employee account information.

- Finally, keep track of inaccuracies and other errors to improve your payroll structure in the future.

We can’t deny that the payroll management process is time-consuming and inconvenient.

Let’s take a closer look at some of the biggest challenges of payroll processing.👀

Challenges Of Payroll Processing

In this blog, we’ll discuss the 9 biggest payroll challenges and ways you can adopt to eliminate them.🚀

➡️ Statutory Compliance & Legislation Issues

Running a company isn’t a cakewalk.❌ Staying compliant is one of the biggest challenges of payroll processing. Labor laws, state regulations, and statutory compliances are only a few of the legislation and rules that exist. Following these laws is not an option; it is necessary!✅

On the other hand, making compliance mistakes isn’t necessarily a decision; many people simply don’t understand intricate regulations. Plus, they get revised from time to time!

This can result in significant fines and penalties for your company. Honestly, it doesn’t sound like something you want!☹️

Furthermore, most businesses rely on conducting payroll manually or entrusting the task to their HR staff. You must realize that no matter how much time you devote to learning the compliance regulations, they will change, and you will be back to square one.

This might pose a challenge that will end up causing major distractions in the process of payroll generation.

➡️ Evolution Of Technology

The blind trust in the technology can end up being one of the biggest global payroll challenges we face in 2021. Chances are that the blind faith in these can turn out to be faulty in the long course of time.

This is where we pan out to be wrong and not on the correct path. Technology does make the process of payroll generation easy and a lot streamlined doesn’t mean it is going to be accurate every single time. ❌

Good and effective payroll software do have the capability to alleviate the issues many face with their payroll management process but it is important to be very aware of which technology to opt for and which ones to trust. Every single prospect of the payroll service provider should be very well verified to avoid any kind of further risks.

➡️ Need For Higher Flexibility

Payroll management is not restricted to merely paying off your workforce.

COVID-19 has caused significant changes for several businesses, necessitating increased flexibility. For instance, a company may have reduced or modified its work shifts, necessitating frequent and major changes to employees’ schedules, influencing leave, payroll, and other operations to coordinate and compute overtime and other payouts.

Businesses are evolving daily and are reinventing entire product lines due to changing market demands. This involves dealing with a lot of important tasks leaving almost no time to get caught up in payroll related challenges.

Many businesses have also been forced to deal with remote work, which necessitates coordinating schedules and remote payroll management across multiple locations.

There are no easy ways to avoid these payroll and compliance challenges using the manual payroll process. However, using an automated payroll management system can help you overcome these difficulties easily!😍

➡️ Shortage Of Payroll Professionals

Payroll industry has recently experienced a booming increase in their demand and popularity. The last few years are what has boosted the overall growth of this industry. This is the reason why the demand and the supply are posing a problem altogether.

The year of 2021, in terms of payroll challenges, might experience a shortage in the number of talented professionals in this field. Finding well equipped and well trained and experienced payroll professionals is turning out to be a problem in the coming year or so. But, the same can also be mitigated effectively owing to the kind of growth it is gaining over the years.

➡️ Challenges In Attendance & Leave Management

Employee attendance is frequently tracked and time-stamped by card swipe, finger-print punches in/out, or simply by ‘signing in’ one’s name on a worksheet with manual payroll processing. To calculate the pay and other incentives, that ‘data’ must be carefully duplicated, imported or exported, and passed around teams before making it authorized.

Managerial permissions and modifications are sometimes required. Because of the mountain of paperwork and individuals involved, this simple daily operation takes a lot of time and effort, so errors and inconsistencies are common.

➡️ Challenges In Handling Remote Work

With so many employees working remotely from home or even overseas during COVID-19, traditional HR and payroll administration is nearly impossible.☹️

Card readers and sign-in forms are ineffective for attendance management. Hard copy management of leave and compensation is no longer possible. Email processing can be chaotic due to the numerous submissions, manager approvals, verifications, and coordination necessary.

Furthermore, with the pandemic looming, the typical onboarding and offboarding process, which involves many documentation and face-to-face meetings, is no longer feasible.❌

In such circumstances, a system that can automate remote attendance, leave requests, performance management, training, and other HR and payroll operations is more important than ever.😇

➡️ Consistent Automation

Automation is taking the world by a whirlwind. While the same might be an amazing addition to the overall prospects of the growth and development, the same is also believed to become a potent challenge for the overall global payroll system in the year of 2021. Automation might enhance the payroll management process so much that it could become a lot harder to cope up with the pace of it with manual inputs.

The capabilities and workforce implemented by the automation are also going to undergo a rapid change and evolution which might further end up contributing to the overall payroll system even further. It is a wrong notion that the inclusion of automation is going to end up making manual labor redundant.

That is not going to be the case. Rather, the same is believed to impact the overall growth in the end but the initial impacts might impose a bit of challenge for the people working in the payroll industry.

➡️ Threat To Data Security

With the ever-growing realms of technology, the amount of threat and risks are on the rise as well. It is not surprising that more and more people are finding it hard to keep their data and information encrypted and safe. The same does go out to the payroll industry as well. The kind of threats to the stored information is not necessarily new.

More and more reports of cyber crimes and cyber breaches are on the rise and the same might inflict impacts on the overall prospects of the payroll industry as well.

The payroll industry and the data associated with it might be on the risks and that is expected to stand out as one of the possible challenges in the year 2021. That being said, the security is also strengthened and that itself could pan out to be quite beneficial on the whole as well.🚀

➡️ Inconsistency In Policies

Company processes and policies can be subjected to change a number of times. That being said, that can actually pan out to be one of the most common challenges faced by the payroll industry.

Given the fact that this relies on the right in the moment and current and updated information to be relayed to the employees, it is not surprising that the same might end up being a challenge in the coming few months.

Companies and organizations are constantly changing their processes and policies and while that might be a good thing for the company, the consistent changes pan out to be a trouble for the professionals under the payroll industry.

If you are someone willing under this similar situation, be assured to stay in consistent sync with the companies you are working along with. This will help in keeping track of the changes and making the necessary changes accordingly.

Challenges In Payroll Computation

Some small and medium-sized businesses continue to use excel sheets to manage all payroll-related data, resulting in several issues:👇

- Incorrect payments are the result of data entry errors and rule misapplication.

- Data is dispersed in such a way that HR and tax audits are difficult to manage.

- Payroll records are difficult to handle, and accessing them can be problematic.

- The information being filed is difficult to comprehend for the managers who approve it.

- Compiling statistics and preparing reports for high management as a reference has proven difficult.

Even businesses that use payroll management software may be utilizing outdated versions that are unproductive due to a lack of features critical to increasing efficiency. ❌ Some of the drawbacks of older software applications are as follows:👇

- Not tailored to the company’s operations, rules, and requirements

- Other HR information and tools, such as attendance, leave, claims, employee benefits, and so on, are not interconnected.

- Does not automatically adapt to the frequency of statutory updates.

Overcoming The Payroll Challenges 2021

The Payroll industry is a very dynamic industry with consistent updates and changes. While payroll is currently gaining popularity, it goes without saying that the obstacles and challenges that the coming months bring along are quite extensive.

Payroll processing is not a simple task, which can be handled manually by one person without hassles. There are a series of challenges that impact your accuracy and compliance structure. As a result, non-compliance penalties are levied.

Want to effortlessly eliminate all of these challenges? 😉

You can easily minimize these challenges by using good payroll management software which can easily handle the constantly evolving intricacies of payroll.✅